Investment Management

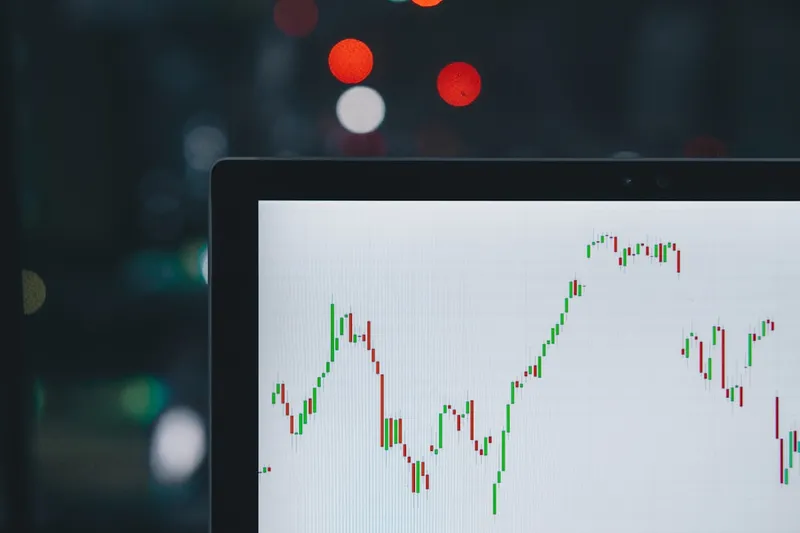

Strategic portfolio management with focus on long-term growth and risk mitigation. We create personalized investment strategies that align with your business goals.

- Portfolio diversification strategies

- Risk assessment and management

- Performance monitoring and reporting

- ESG investment options